A new salary-advance solution, borofree has launched in the UK offering employers the opportunity to provide staff with an interest free, charge free and cost-free method of borrowing against their next pay cheque.

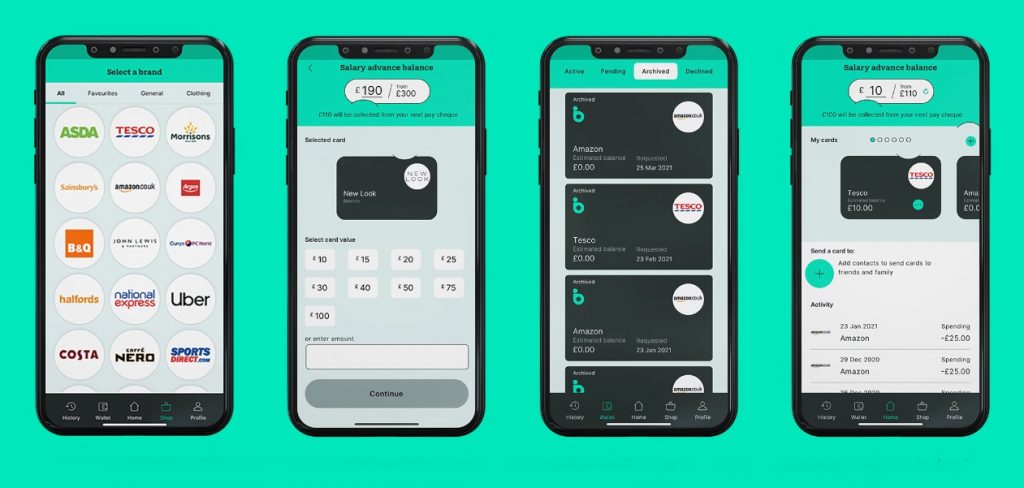

borofree works with employers to provide staff with access to a proportion of their salary ahead of payday to purchase products and services through retailer-specific gift cards. Inspired by the need for a customer-friendly financial solution, borofree was developed to enable employers to support hard working employees improve their financial wellbeing and confidence. From those budgeting for household goods at the start of each month, to professionals who may have a cash flow issue as they approach the end of the month, borofree has been created for anyone who might require that bit of extra help.

A recent independent study of 2,000 UK employees commissioned by borofree has shown the impact that financial concerns have had on working Britons over the last year. According to the study carried out by YouGov, over a fifth (23%) of UK adults have been unable to afford to pay for key household expenses including basics such as food and clothing and mortgage, rent and utility bills at some point during the pandemic. A similar proportion (19%) have seen a fall in their income during the last 12-months, rising to over a third (35%) of those in part-time work. Around 1 in 10 (9%) of families with children have had to forgo buying birthday and Christmas presents in the last year.

The study also revealed that more than 1 in 10 (12%) UK employees have found that financial worries, caused by the Covid-19 pandemic, have impacted their productivity and ability to perform at work over the past 12 months.

Cost-free for both employers and employees, borofree will enable companies to support their staff in combating financial stresses. Employees who sign up to borofree will have access to over 50 popular high street stores and online retailers, including John Lewis, ASDA, B&Q and National Express. The range of partners aims to support the UK’s hard-working workforce tackle unexpected expenses and purchase essentials without entering into unfair debt and fees.

Minck Hermans, CEO of Borofree, said: ‘More often than not, employers are unaware of how financial concerns could be affecting their employees and the impact this could have on their business. We want to help hard-working adults get financial support in a way that is responsible, preventing them from going down alternative routes such as payday loans, which come with high interest rates and often lead to increased levels of debt and stress.

By offering borofree’s ‘all zero’ solution to employees, businesses now have the opportunity to support staff wellbeing and mental health by giving greater financial confidence, leading to increased productivity at work, at no cost. Not only that but in providing a benefit that is actually useful and used, employers are likely to see a greater level of staff retention.’

For employers who’d like to find out more about how it all works, visit the borofree website.